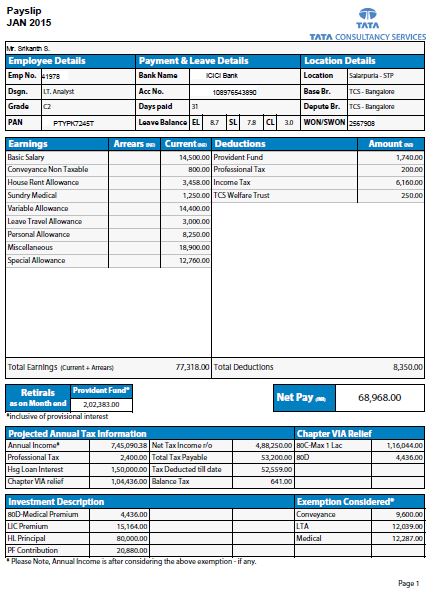

The exemption limit for medical allowance is 15,000, the amount exceeds becomes taxable. Medical allowance can also be used to cover the costs of employees’ health insurance premiums. The employee only gets the claim on the submission of medical bills as proof.

Medical allowance to cover the cost of medical expenses during the employment period.

The amount of HRA depends on the city or town where the employee lives and their salary. House Rent Allowance (HRA) is a reimbursement for the rent that the employee pays for the accommodation. So private companies may or may not pay DA to their employees. Note – DA is mandatory for government employees but optional for private employers. The amount of dearness allowance payable is determined by the government, based on the consumer price index (CPI). It is a fixed percentage (usually 30-40%) of the employee’s basic salary and is paid in addition to the regular salary.ĭearness allowance is a cost-of-living adjustment paid by the government to government employees and pensioners. It is the starting point of any calculation of gross pay.ĭearness allowance (DA) is a component of salary that is paid to employees to offset the impact of inflation. Usually, it is fixed at 35-40% of the total salary. Also read – How to earn money online for students in India Income Components of Salary SlipĮmployees’ basic salary is a fixed amount of monthly salary.

0 kommentar(er)

0 kommentar(er)